In this guide, we take a look at Medicare rate increases from 2020 to 2021 to shed some light on what we can expect for Medicare costs going forward.

We also outline some 2022 Medicare cost projections based on the annual Medicare Trustees Report.

Have you heard of Medicare deductible? It’s just the annual payment that you have to make plus the premium for the Original Medicare plan. You should know that Medicare deductible 2021 will be higher than what you pay right now. If you don’t pay the annual deductible, you won’t get any coverage. So, it’s quite essential for you to pay.

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries will be $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. Part B monthly premiums are based on a person’s income. Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $445 in 2021. Some Medicare drug plans don't have a deductible.

2021 Medicare Part B Costs

The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium.

While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

The table below shows the additional amount these beneficiaries will pay in 2021 — called the Income-Related Monthly Adjustment Amount, or IRMAA — based on their reported 2019 income.

| 2019 Individual tax return | 2019 Joint tax return | 2019 Married and separate tax return | 2021 Part B premium |

|---|---|---|---|

| $88,000 or less | $176,000 or less | $88,000 or less | $148.50 |

| More than $88,000 and up to $111,000 | More than $176,000 and up to $222,000 | N/A | $207.90 |

| More than $111,000 up to $138,000 | More than $222,000 up to $276,000 | N/A | $297.00 |

| More than $138,000 up to $165,000 | More than $276,000 up to $330,000 | N/A | $386.10 |

| More than $165,000 up to $500,000 | More than $330,000 up to $750,000 | More than $88,000 up to $412,000 | $475.20 |

| More than or equal to $500,000 | More than or equal to $750,000 | More than $412,000 | $504.90 |

Medigap plans can help cover your 2021 Medicare costs.

Compare plans

2021 Medicare Part A Cost Increases

Most people receive premium-free Part A.

In 2021, people who are required to pay a Part A premium must pay either $259 per month or $471 per month, depending on how long they or their spouse worked and paid Medicare taxes.

Those are increases of $7 and $13 per month respectively from 2020 Part A premiums. The costs may increase again in 2022.

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible.

The Part A deductible amount may increase each year, and it will likely be higher in 2022.

2022 Medicare Part B Cost Projections

Based on reporting from the Centers for Medicare & Medicaid Services (CMS), the projected 2022 Medicare Part B premium is $157.70 per month.1

Medicare Part B Premium 2021

It's important to note that this figure only represents an estimate of 2022 Part B premiums. Actual 2022 premiums will be determined in the fall of 2021.

Will My Medicare Supplement Insurance Premiums Go Up?

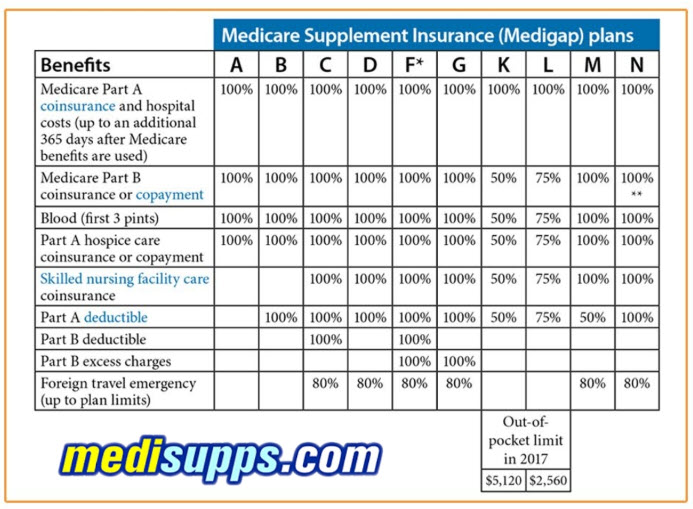

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments.

The average a Medigap plan premium in 2018 was $125.93 per month.2

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher.

Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Compare 2021 Medicare Supplement Insurance Plan Costs

A licensed insurance agent can help you find Medigap plans that are available where you live. You can find out the types of benefits each available plan may offer, the insurance companies that sell them and the premium costs you can expect to pay.

You can request an online plan comparison for free, with no obligation to enroll.

Find Medigap plans in your area.

Compare plans1 Medicare: Part B Premiums. (Updated May 6, 2020). EveryCRSReport.com. Retrieved from www.everycrsreport.com/reports/R40082.html.

2 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

- EPIC 2021 Program Highlights is also available in Portable Document Format (PDF, 3 pgs.)

EPIC Program:

- Annual income for eligibility is up to $75,000 for singles and $100,000 for married couples.

- Members must be enrolled in a Medicare Part D drug plan to receive EPIC benefits.

- Provides secondary coverage for Medicare Part D and EPIC covered drugs purchased after the Part D deductible, if any, is met.

- Covers many Part D excluded drugs.

- EPIC co-payments continue to be $3, $7, $15 or $20 based on the cost of the drug.

- Provides Medicare Part D drug plan premium assistance for many members.

2021 Medicare Premiums And Deductibles

Fee Plan Members:

- EPIC annual fees range from $8 - $300 based on the previous year's income.

- EPIC pays the Part D monthly drug plan premiums up to the average cost of a basic Medicare drug plan, $42.27 per month in 2021.

- Bills are mailed quarterly for EPIC fee plan members. Members with full Extra Help from Medicare will continue to have their EPIC fees waived.

- Members will pay EPIC co-payments for Part D and EPIC covered drugs after the Part D deductible, if any, is met. Members will pay EPIC co-payments for Part D excluded drugs.

Deductible Plan Members:

- EPIC deductibles range from $530 - $3,215 based on the previous year's income.

- EPIC pays the monthly Part D drug plan premiums up to the average cost of a basic Part D drug plan for members with income up to $23,000 single and $29,000 married.

- Members with higher incomes must pay their Medicare Part D premiums each month. Their EPIC deductible will be lowered by the annual cost of a basic Part D plan (approximately $508) to help them pay.

- After a member meets their EPIC deductible, they will pay EPIC co-payments for covered drugs. Drug costs in the Part D deductible phase cannot be applied to the EPIC deductible.

Fee Plan Schedule:

The cost to join the Fee Plan is based on your previous year's income. You can pay your Annual Fee in total or pay a bill every three months. EPIC fees are waived for those with full Extra Help from Medicare.

EPIC pays Part D Premium| Up to $6,000 | $8 | |

| $ 6,001 - $ 7,000 | $16 | |

| $ 7,001 - $ 8,000 | $22 | |

| $ 8,001 - $ 9,000 | $28 | |

| $ 9,001 - $10,000 | $36 | |

| $10,001 - $11,000 | $40 | |

| $11,001 - $12,000 | $46 | |

| $12,001 - $13,000 | $54 | |

| $13,001 - $14,000 | $60 | |

| $14,001 - $15,000 | $80 | |

| $15,001 - $16,000 | $110 | |

| $16,001 - $17,000 | $140 | |

| $17,001 - $18,000 | $170 | |

| $18,001 - $19,000 | $200 | |

| $19,001 - $20,000 | $230 | |

| See Deductible Plan | Over $20,000 | See Deductible Plan |

Medicare Part B Deductible 2021

EPIC pays Part D Premium

| Up to $ 6,000 | $ 8 | |

| $ 6,001 - $ 7,000 | $12 | |

| $ 7,001 - $ 8,000 | $16 | |

| $ 8,001 - $ 9,000 | $20 | |

| $ 9,001 - $10,000 | $24 | |

| $10,001 - $11,000 | $28 | |

| $11,001 - $12,000 | $32 | |

| $12,001 - $13,000 | $36 | |

| $13,001 - $14,000 | $40 | |

| $14,001 - $15,000 | $40 | |

| $15,001 - $16,000 | $84 | |

| $16,001 - $17,000 | $106 | |

| $17,001 - $18,000 | $126 | |

| $18,001 - $19,000 | $150 | |

| $19,001 - $20,000 | $172 | |

| $20,001 - $21,000 | $194 | |

| $21,001 - $22,000 | $216 | |

| $22,001 - $23,000 | $238 | |

| $23,001 - $24,000 | $260 | |

| $24,001 - $25,000 | $275 | |

| $25,001 - $26,000 | $300 | |

| See Deductible Plan | Over $26,000 | See Deductible Plan |

Deductible Plan Schedule:

There is no fee to join the Deductible Plan. You pay full price (Part D amount charged) for your drugs until you meet your Annual Deductible which is based on your previous year's income. EPIC tracks how much you spend. Drug costs in the Medicare Part D deductible phase cannot be applied to the EPIC deductible.

EPIC pays Part D Premium| Under $20,000 | See Fee Plan | |

| $20,001 - $21,000 | $530 | |

| $21,001 - $22,000 | $550 | |

| $22,001 - $23,000 | $580 | |

| Member pays their Part D premium (shaded incomes). EPIC Deductible shown is lowered by approximately $508 to help them pay. | $23,001 - $24,000 | $720 |

|---|---|---|

| $24,001 - $25,000 | $750 | |

| $25,001 - $26,000 | $780 | |

| $26,001 - $27,000 | $810 | |

| $27,001 - $28,000 | $840 | |

| $28,001 - $29,000 | $870 | |

| $29,001 - $30,000 | $900 | |

| $30,001 - $31,000 | $930 | |

| $31,001 - $32,000 | $960 | |

| $32,001 - $33,000 | $1,160 | |

| $33,001 - $34,000 | $1,190 | |

| $34,001 - $35,000 | $1,230 | |

| $35,001 - $36,000 | $1,260 | |

| $36,001 - $37,000 | $1,290 | |

| $37,001 - $38,000 | $1,320 | |

| $38,001 - $39,000 | $1,350 | |

| $39,001 - $40,000 | $1,380 | |

| $40,001 - $41,000 | $1,410 | |

| $41,001 - $42,000 | $1,440 | |

| $42,001 - $43,000 | $1,470 | |

| $43,001 - $44,000 | $1,500 | |

| $44,001 - $45,000 | $1,530 | |

| $45,001 - $46,000 | $1,560 | |

| $46,001 - $47,000 | $1,590 | |

| $47,001 - $48,000 | $1,620 | |

| $48,001 - $49,000 | $1,650 | |

| $49,001 - $50,000 | $1,680 | |

| $50,001 - $51,000 | $1,710 | |

| $51,001 - $52,000 | $1,740 | |

| $52,001 - $53,000 | $1,770 | |

| $53,001 - $54,000 | $1,800 | |

| $54,001 - $55,000 | $1,830 | |

| $55,001 - $56,000 | $1,860 | |

| $56,001 - $57,000 | $1,890 | |

| $57,001 - $58,000 | $1,920 | |

| $58,001 - $59,000 | $1,950 | |

| $59,001 - $60,000 | $1,980 | |

| $60,001 - $61,000 | $2,010 | |

| $61,001 - $62,000 | $2,040 | |

| $62,001 - $63,000 | $2,070 | |

| $63,001 - $64,000 | $2,100 | |

| $64,001 - $65,000 | $2,130 | |

| $65,001 - $66,000 | $2,160 | |

| $66,001 - $67,000 | $2,190 | |

| $67,001 - $68,000 | $2,220 | |

| $68,001 - $69,000 | $2,250 | |

| $69,001 - $70,000 | $2,280 | |

| $70,001 - $71,000 | $2,310 | |

| $71,001 - $72,000 | $2,340 | |

| $72,001 - $73,000 | $2,370 | |

| $73,001 - $74,000 | $2,400 | |

| $74,001 - $75,000 | $2,430 | |

| Not Eligible | Over $75,000 | Not Eligible |

EPIC pays Part D Premium

| Under $26,000 | See Fee Plan | |

| $26,001 - $27,000 | $650 | |

| $27,001 - $28,000 | $675 | |

| $28,001 - $29,000 | $700 | |

| Member pays their Part D premium (shaded incomes). EPIC Deductible shown is lowered by approximately $508 to help them pay. | $29,001 - $30,000 | $725 |

|---|---|---|

| $30,001 - $31,000 | $900 | |

| $31,001 - $32,000 | $930 | |

| $32,001 - $33,000 | $960 | |

| $33,001 - $34,000 | $990 | |

| $34,001 - $35,000 | $1,020 | |

| $35,001 - $36,000 | $1,050 | |

| $36,001 - $37,000 | $1,080 | |

| $37,001 - $38,000 | $1,110 | |

| $38,001 - $39,000 | $1,140 | |

| $39,001 - $40,000 | $1,170 | |

| $40,001 - $41,000 | $1,200 | |

| $41,001 - $42,000 | $1,230 | |

| $42,001 - $43,000 | $1,260 | |

| $43,001 - $44,000 | $1,290 | |

| $44,001 - $45,000 | $1,320 | |

| $45,001 - $46,000 | $1,575 | |

| $46,001 - $47,000 | $1,610 | |

| $47,001 - $48,000 | $1,645 | |

| $48,001 - $49,000 | $1,680 | |

| $49,001 - $50,000 | $1,715 | |

| $50,001 - $51,000 | $1,745 | |

| $51,001 - $52,000 | $1,775 | |

| $52,001 - $53,000 | $1,805 | |

| $53,001 - $54,000 | $1,835 | |

| $54,001 - $55,000 | $1,865 | |

| $55,001 - $56,000 | $1,895 | |

| $56,001 - $57,000 | $1,925 | |

| $57,001 - $58,000 | $1,955 | |

| $58,001 - $59,000 | $1,985 | |

| $59,001 - $60,000 | $2,015 | |

| $60,001 - $61,000 | $2,045 | |

| $61,001 - $62,000 | $2,075 | |

| $62,001 - $63,000 | $2,105 | |

| $63,001 - $64,000 | $2,135 | |

| $64,001 - $65,000 | $2,165 | |

| $65,001 - $66,000 | $2,195 | |

| $66,001 - $67,000 | $2,225 | |

| $67,001 - $68,000 | $2,255 | |

| $68,001 - $69,000 | $2,285 | |

| $69,001 - $70,000 | $2,315 | |

| $70,001 - $71,000 | $2,345 | |

| $71,001 - $72,000 | $2,375 | |

| $72,001 - $73,000 | $2,405 | |

| $73,001 - $74,000 | $2,435 | |

| $74,001 - $75,000 | $2,465 | |

| $75,001 - $76,000 | $2,495 | |

| $76,001 - $77,000 | $2,525 | |

| $77,001 - $78,000 | $2,555 | |

| $78,001 - $79,000 | $2,585 | |

| $79,001 - $80,000 | $2,615 | |

| $80,001 - $81,000 | $2,645 | |

| $81,001 - $82,000 | $2,675 | |

| $82,001 - $83,000 | $2,705 | |

| $83,001 - $84,000 | $2,735 | |

| $84,001 - $85,000 | $2,765 | |

| $85,001 - $86,000 | $2,795 | |

| $86,001 - $87,000 | $2,825 | |

| $87,001 - $88,000 | $2,855 | |

| $88,001 - $89,000 | $2,885 | |

| $89,001 - $90,000 | $2,915 | |

| $90,001 - $91,000 | $2,945 | |

| $91,001 - $92,000 | $2,975 | |

| $92,001 - $93,000 | $3,005 | |

| $93,001 - $94,000 | $3,035 | |

| $94,001 - $95,000 | $3,065 | |

| $95,001 - $96,000 | $3,095 | |

| $96,001 - $97,000 | $3,125 | |

| $97,001 - $98,000 | $3,155 | |

| $98,001 - $99,000 | $3,185 | |

| $99,001 - $100,000 | $3,215 | |

| Not Eligible | Over $100,000 | Not Eligible |

Questions? Call the EPIC Helpline at: 1-800-332-3742 (TTY 1-800-290-9138)

¿Necesita Ayuda? Llame al 1-800-332-3742

September 2020